What entity type is best for my startup?

If you’re starting a business, you likely know about the availability of different forms of funding to help get you off the ground. Securing funding is often a critical step towards growth and success. However, fundraising can be an all-consuming task, and one that’s hard to navigate if you haven’t done it before. That’s where fractional CFO services come in. In this article, we’ll explore how a fractional CFO can help assess risks and opportunities to your business plan, create a financial model to inform your fundraise, and construct a fundraising plan. We will also provide you with 10 actionable steps to prepare for your startup’s fundraise – even if you don’t have a fractional CFO (yet).

What is a Fractional CFO?

Let’s level-set with a primer on what a fractional CFO does. A fractional CFO is a financial professional who provides part-time CFO services to startups and small businesses. Unlike a full-time CFO, a fractional CFO works with multiple clients simultaneously, offering their expertise on a flexible basis. This arrangement allows startups to access the strategic insights and financial management capabilities of a CFO without the cost associated with hiring a full-time employee.

When it comes to startups and small businesses, financial management is crucial for success. However, many startups may not have the resources to hire a full-time CFO. This is where a fractional CFO comes in. They can provide the necessary financial guidance and expertise without the need for the cost that comes with a full-time CFO.

When it comes to helping your startup prepare to raise capital, a fractional CFO’s main job comes long before you intend to fundraise. In an ideal world, you’ll already be working with a fractional CFO to ensure you have accurate and up-to-date historical financial statements, understand your business model from a financial perspective, identify and quantify risks to your business model (as well as opportunities for improvement), and understand the fundraising market (and your plan to navigate it).

Before You Fundraise: Set Yourself Up For Success With Organized Financials

Hold up. Before you start preparing to raise money for your startup, you need to make sure that you have an accurate understanding of your company’s historical financial performance, as it’s the base for any forecasting your fractional CFO will do. At the earliest stages of a startup, this can be as simple as signing up for Quickbooks and accurately tracking all expenses and income. Having accurate and organized historical financials will help your fractional CFO (as well as potential investors) quickly gain a clear understanding of the current state of your business, how your historical expenses have impacted your growth trajectory, and how urgent (or not urgent) the need is to raise money.

Creating a Financial Model for Your Fundraise with Fractional CFO Services

One of the first items potential investors will request from startups seeking to raise capital is the startup’s financial model. A financial model is a quantitative representation of your startup’s financials, including forecasted revenue, expenses, and cash flows.

A fractional CFO can work closely with you to create a robust financial model that accurately reflects your startup’s financial realities and future potential. In order to be fully prepared to work with a fractional CFO in building your financial model, you should have your historical financials, a well-defined budget, and a solid understanding of how (and how fast) your startup plans to grow. If you don’t have these things all formally written down, that’s OK – your fractional CFO can help you get prepared.

Once complete, your financial model should contain a detailed list of assumptions around your future growth and performance, and will produce outputs (usually an income statement, balance sheet, and statement of cash flows, as well as key growth and business metrics) that you and your potential investors can use to pressure-test your startup’s business model.

Having a well-designed financial model can instill confidence in investors and demonstrate that you have a deep understanding of your startup’s financials and growth trajectory. It can also enable you to make informed decisions about your fundraising strategy and adjust your plans as needed. Speaking of which…

Assessing Opportunities And Risks With A Fractional CFO

Once your financial model is built, your fractional CFO will be able to incorporate key assumptions, perform sensitivity analyses, and stress-test your financial model under different scenarios. In doing so, your fractional CFO can help you identify and quantify opportunities for growth, cost savings, and operational efficiencies – and create a plan to capitalize on them. A good startup outsourced CFO can thus reduce the level of uncertainty you and your management team have around making changes to your startup.

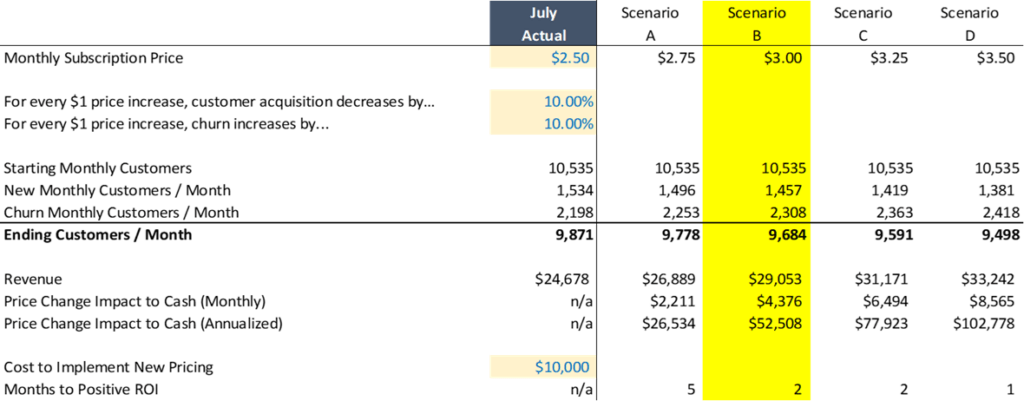

Take, for example, a software company who wants to grow their revenue by raising the price of their subscription-based product by $0.25. In doing so, they anticipate they will lose some of their subscribers, but they aren’t sure how that will impact their overall revenue numbers. Using some simple inputs, your fractional CFO can come up with the following analysis:

A scenario analysis performed for a company considering a price increase.

This analysis lays four scenarios, A, B, C, and D, under which the company’s product increases by $0.25, $0.50, $0.75, and $1.00 respectively. It then calculates, based on an assumptions around decreasing customer acquisition rates and increasing customer churn rate for each additional $1 in price, the change in the number of new customers and number of churned customers for each scenario. Then, it models monthly revenue, and the subsequent impact to profitability each price increase would have on a monthly and annual basis. Finally, it takes into account the cost of implementing the new pricing and calculates the number of months that will pass until the startup achieves a profitable ROI (return on investment) on spending that money to implement the price increase.

As you can see, under these assumptions, raising the company’s prices by $0.50 (Scenario B) would result in a roughly $52k positive impact to the company’s bottom line, and would take roughly 2 months to achieve a positive return on investment.

While this is just one example, these kinds of analyses can help your startup become more certain about the choices in front of you. As you identify these kinds of opportunities, you can build them into your financial model to demonstrate the kind of growth you hope to achieve in the future.

Leveraging a Fractional CFO To Build A Fundraising Plan

With your financial model complete and a solid understanding of the opportunities (and risks!) that your startup faces, you can craft a compelling narrative for potential investors that is substantiated by the assumptions in your financial model. This information will be a critical component of your pitch to potential investors, and the backup behind it will be one of the first parts of due diligence.

Your fractional CFO can help you prepare a pitch deck, identify relevant investors (based on their preferred industry, geography, and stage requirements), and begin contacting those that might have a good fit.

Once you (hopefully!) get to the point of meeting with investors, signing a term sheet, and going through due diligence, your fractional CFO can support you by explaining your business model from a financial perspective, providing information in response to investor requests, and negotiating term sheets.

10 Steps To Prepare for Your Startup’s Fundraise

Now that you understand the role of a fractional CFO in preparing your startup for a fundraise, here’s a summary list of actionable steps you can take to ensure you are well-prepared for the process:

- Evaluate your funding needs and set clear fundraising goals.

- Organize and update your financial records.

- Conduct a thorough due diligence review of your startup’s financials.

- Create a detailed fundraising timeline and action plan.

- Practice your investor pitch and refine your storytelling skills.

- Secure the necessary legal and financial support.

- Prepare financial projections and a financial model.

- Research and identify potential investors.

- Develop a compelling pitch deck and investor presentation.

- Build a diverse advisory board or seek guidance from industry experts.

By following these steps and leveraging fractional CFO services, you can position your startup for fundraising success. Remember, fundraising is not just about the money; it’s also an opportunity to showcase your vision, passion, and ability to execute. With the right financial guidance and preparation, you can attract the investment you need to fuel your startup’s growth.

Next Steps

We hope this article gives you some helpful context on how a fractional CFO can help you prepare for your next fundraising process. At the end of the day, having a solid financial plan (and the ability to explain that plan to potential investors) is a powerful tool when it comes to fundraising – it shows investors that you have a good idea about how you will earn them a return on their investment.

Are you gearing up to raise money? If so, in case you can’t already tell, we highly recommend getting in touch with a fractional CFO to help you along the way. Schedule a call with one of our team members today to learn more about how our CFO Services team can help you prepare for your upcoming fundraise!

Jul 7, 2023 4:42:00 PM

.jpg?width=500&height=500&name=Untitled%20design%20(1).jpg)