Obvious (and Not-So-Obvious) Ways to Manage Cash Burn

A SaaS business financial model helps founders plan and track a software company’s operations effectively. While it may differ for every SaaS company, a model provides frameworks for making decisions and measuring key indicators such as revenue, expenses, and other KPIs.

For example, you and your team can adjust your pricing or marketing tactics to ensure you’re constantly progressing toward achieving your goals.

A well-built model will help you lay a solid financial foundation for your SaaS business. Getting it right the first time can save time and stress by creating a roadmap to follow along the path to success.

What is a SaaS Business Financial Model?

A SaaS business financial model is a set of assumptions and projections helpful in estimating a company’s future performance. Creating a model typically involves making a budget and forecasting cash flow, revenue, expenses, and profitability over time.

A robust model will also consider:

- Customer acquisition costs

- Retention rates

- Pricing structure

- Operating costs

- Capital investments

- Scalability

It is essential to build accurate projections to understand the resources needed to reach desired goals.

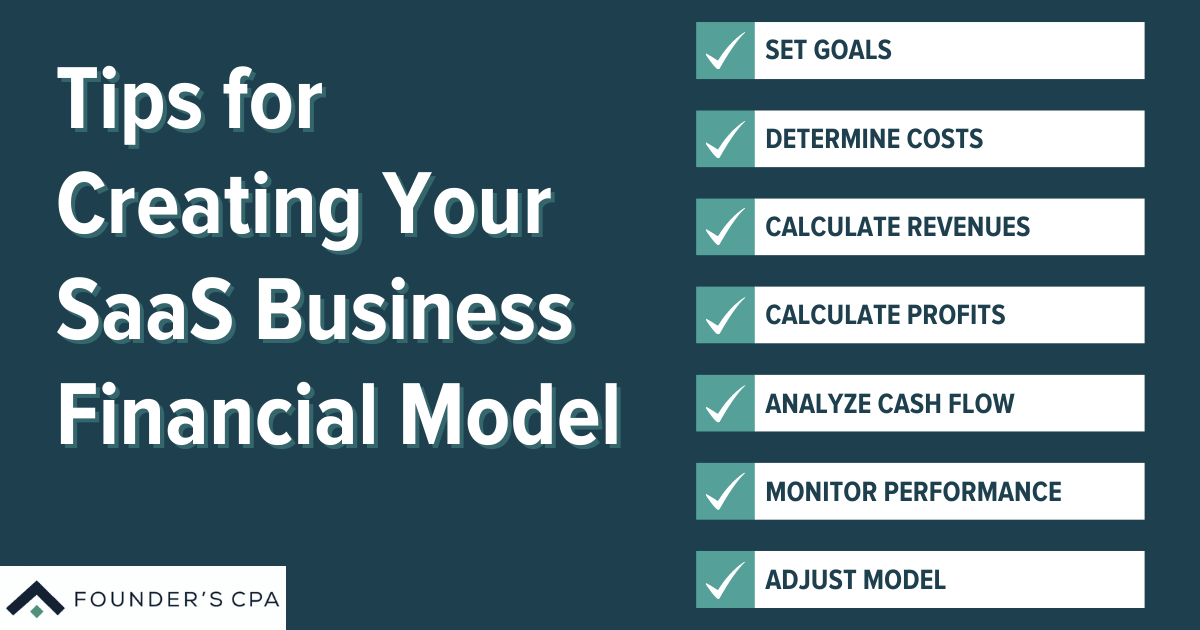

Tips for Creating Your SaaS Business Financial Model

1. Set Goals

Clear and measurable goals that align with your business’s short- and long-term financial and non-financial objectives can help guide your SaaS business.

- Short-Term Goals are the current financial metrics to improve on the way to achieving a long-term financial goal. For example, to double sales over the next year, set a short-term goal of increasing sales by 10% each month.

- Long-Term Goals are the forward-looking financial targets you will work towards (e.g., up to five years). For instance, if you want to 5x revenue over three years, set a long-term goal of increasing revenue by 70% per year while growing your cost base at 15% per year.

Defining your objectives drives your decisions in the right direction.

2. Determine Costs

Which costs are associated with your SaaS project? Software, hardware, personnel, and other resources are often necessary for delivering a great product. Remember also to consider marketing costs, which can be significant for SaaS businesses.

Defining the costs of running your SaaS business will help you identify how many customers and at which price you will reach breakeven when your business no longer consumes cash.

3. Calculate Revenues

To estimate the expected revenues from your SaaS project, consider your desired pricing model, the number of customers, and projected growth rates.

The main goal of your financial model is to create a forecast that shows how much money you expect to make from the project in a year.

Sometimes, analyzing your competitors’ business models is a savvy way to start. Try to understand their revenue sources and how much they make per customer. Once you have some numbers for comparison, you can crosscheck your assumptions.

4. Calculate Profits

Businesses must generate profits to stay alive, and calculating profits is crucial in creating your SaaS business financial model. A spreadsheet is sufficient for calculating expected earnings if your company is simple enough.

The profit calculation will help you create a complete business picture and realistic budget expectations. Calculating expected profits helps assess your SaaS project’s long- and short-term viability.

5. Analyze Cash Flow

Sufficient cash is always necessary to meet your business obligations. Cash flow analysis is a tool that can help you determine the cash requirements of your product or service. The cash flow statement shows how much revenue is coming into your business, how much you spend on operations, and how much is left to invest.

Carefully monitoring the cash flow associated with your SaaS project, including the costs of operations, investments, and other financing activities, will ensure you have enough reserves to cover your obligations.

6. Monitor Performance

Monitor the performance of your SaaS project regularly, including tracking the number of customers, their level of engagement, and other key performance indicators.

If you have a lower customer retention rate than expected, it’s time to take action. You can often improve retention by adjusting marketing tactics or adding new features to your product. Testing different pricing structures to see which works best for your business is also helpful.

Regularly tracking your company’s performance will help you understand what’s happening and why. You’ll be able to determine how effective your marketing tactics are at retaining customers and generating revenue.

7. Adjust Model

A SaaS business financial model is a reference tool to help you make better financial decisions. But significant industry shifts can impact your business model.

When this happens, you can revisit your initial assumptions, revise sales and marketing budgets, and review your cost of capital to adjust your SaaS business financial model as needed.

Scale Your Business with a SaaS Business Model

When you run a SaaS business, a business model that provides a roadmap for your organization can help you make better decisions that drive you forward. Once you know what to expect and what’s possible, it’s natural to start strategizing how to move forward.

A robust SaaS business financial model is invaluable to creating a successful business.

Getting started with a business model can feel challenging, but the experts at Founders can help you build something that reflects your current situation, goals for the future, and the realities of the market. Contact our team today to get started on your SaaS business financial model.

Jun 4, 2024 1:26:09 PM